Sanction screening is a process in which companies check their business partners, debtors, employees, and transactions against national and international sanction lists. These lists contain individuals, organizations, and countries that have been sanctioned due to illegal activities, terrorism, or other threats.

Monitored Risks

Sanction screening monitors various risks, including:

- Terrorism Financing: Preventing the financing of terrorist activities.

- Money Laundering: Detecting and preventing money laundering activities.

- Trade Restrictions: Ensuring compliance with trade restrictions and embargoes.

- Reputational Risks: Protecting the company from negative impacts on its reputation due to connections with sanctioned parties.

Importance for Companies

Sanction screening is important for companies for several reasons:

- Legal Requirements: Compliance with legal regulations and avoidance of penalties.

- Risk Management: Minimizing financial and legal risks.

- Business Integrity: Ensuring ethical business practices and protecting the company’s image.

- Avoiding Business Interruptions: Avoiding sanctions that could disrupt business operations.

By implementing effective sanction screening, companies can ensure that they act in compliance with the law and that their business relationships are safe and trustworthy.

Sanction Screening with 365 business Sanction Screen

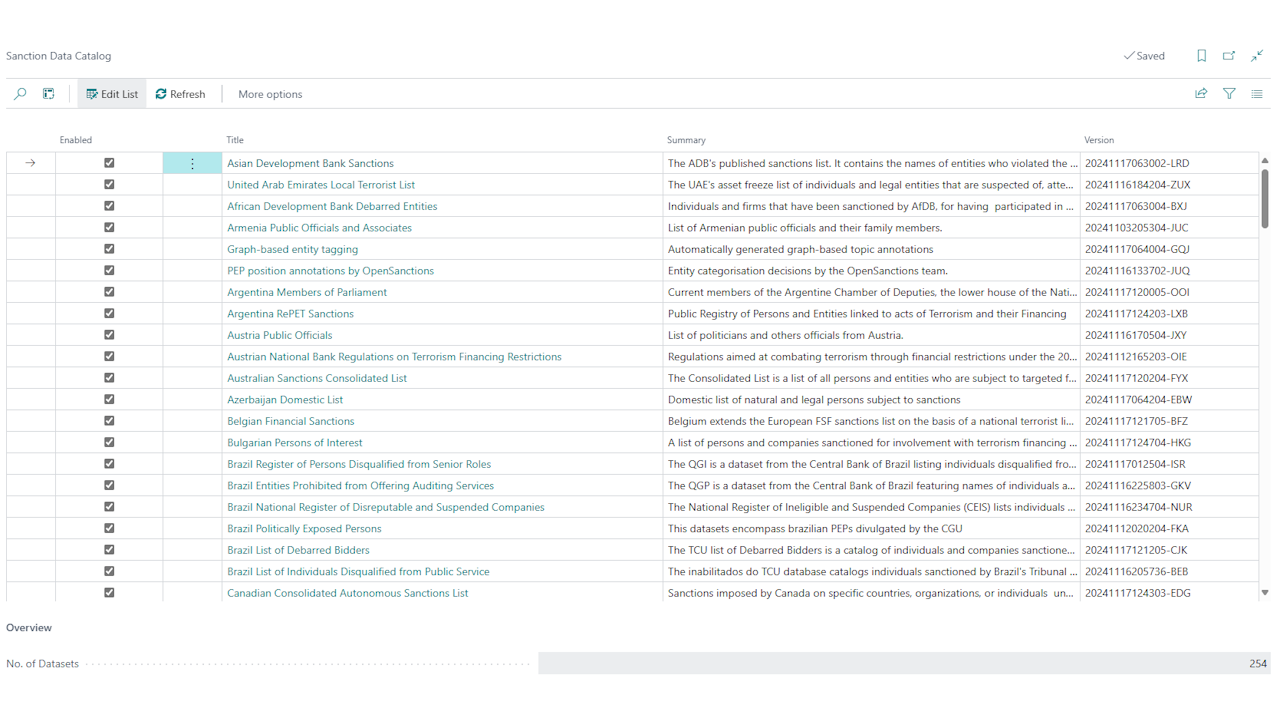

365 business Sanction Screen is a solution that helps companies conduct their sanction screenings efficiently and automatically. The solution offers comprehensive coverage of over 240 data sources and enables fully automated sanction screening with configurable intervals for each entity. User-friendly visualizations and configurable notifications facilitate the monitoring and management of sanction list checks in real-time.

For more information, see here.